Payroll Software UAE: Top 15 WPS-Compliant Picks (2026)

Payroll software uae is a system that automates salary calculations, prepares mandatory WPS files, tracks end of service gratuity, and keeps audit-ready records. While payroll in the UAE can seem simple at first, complexities like WPS rules and new corporate tax deadlines quickly appear. The right software turns these challenges into a manageable checklist, so teams can pay staff on time, stay compliant, and focus on growth.

What is payroll software in the UAE context

Payroll software uae is a system that calculates salaries and allowances, prepares WPS files for bank or exchange house submission, tracks leave and end of service, and keeps audit trails for MoHRE and tax reviews. In the UAE, a practical tool must also generate SIF files with employee and control records and keep the payment currency in AED. (uabwps.com)

How it works in practice

- Pulls employee data and contract terms, then computes gross to net for each pay cycle

- Creates a Salary Information File with EDR and SCR lines for WPS submission, validates totals, and maps basic pay and variable pay fields correctly

- Stores confirmations and receipts, which you will need for inspections and tax audits

- Exports reports for finance and HR, including gratuity accruals and leave salary

If you want a single place for recruiting, onboarding, payroll, and EOR, consider an all in one platform like Bolto.

Why businesses in the UAE need payroll software

- WPS is mandatory for private sector companies under MoHRE, and it has run nationwide since 2009 under the Central Bank, so you need software that can generate compliant files every month. (centralbank.ae)

- An employer is considered late if wages are not paid within 15 days after the due date, so automated calendars and alerts matter. (mohre.gov.ae)

- Fines apply for WPS breaches, including 1000 dirhams per worker for failure to pay on due dates through WPS and 5000 dirhams per worker for submitting incorrect data or forcing fake payslips. (gulfnews.com)

- Corporate tax requires record keeping and timely returns, which good payroll reports support. Returns are due within nine months of the period end, and records must be kept for at least seven years. (mof.gov.ae)

- End of service gratuity has clear statutory formulas, and software that tracks basic salary and service time avoids expensive errors. (thenationalnews.com)

If you are growing fast or hiring across borders, Bolto also combines recruiting, UAE payroll, and global EOR in one workflow.

UAE compliance essentials you cannot ignore

Wage Protection System basics

- WPS aligns employers, banks, exchanges, MoHRE, and the Central Bank to enforce on time pay. (centralbank.ae)

- Wages are due at least monthly, and late payment rules trigger ministry monitoring and potential blocks on new work permits. (gulfnews.com)

- WPS coverage now spans the vast majority of the private sector workforce. (gulfnews.com)

End of service gratuity

- After one year of service, employees are entitled to gratuity based on basic salary, with 21 days per year for the first five years and 30 days per year thereafter. The total is capped at two years of basic salary. (thenationalnews.com)

Corporate tax and records

- Corporate tax applies at 9 percent for financial years beginning on or after June 1 2023, with taxable income above 375,000 dirhams taxed at 9 percent and amounts below that at zero. Filing is due within nine months. Keep supporting records for seven years. (mof.gov.ae)

Health insurance obligations

- Employer or sponsor provided health insurance is mandatory in Dubai and Abu Dhabi, with implementing rules and enforcement by DHA and the Abu Dhabi Department of Health. Payroll systems should track eligibility and deductions only where allowed. (dlp.dubai.gov.ae)

Data protection rules

- The federal PDPL has applied since January 2 2022 and allows cross border transfers under adequacy and safeguard conditions. Free zones like DIFC and ADGM have their own data protection regimes aligned with international standards. (u.ae)

Key features to look for when buying payroll software uae

Must have items for WPS

- Native WPS file builder with EDR and SCR lines

- AED as default payment currency and correct routing code mapping

- Bank integrations or export profiles tested with local banks and exchanges

- Automated validation for totals and variable allowances in the right SIF fields (uabwps.com)

Compliance automation

- Gratuity accruals based on basic salary and continuous service

- Alerts for late pay risk at day 10 and day 15 and blocks before day 17

- Document storage for contracts, SIF files, and payment confirmations (gulfnews.com)

Reporting and controls

- Audit ready ledgers for tax and MoHRE checks, with seven year archive options for corporate tax compliance

- Multi entity support for mainland and free zone setups

- Role based access and maker checker approval flows (tax.gov.ae)

HR and recruiting connection

- Smooth onboarding into payroll, with leave and allowance sync

- Option to add global hiring through EOR or contractor management if you scale beyond the UAE

Want one stack that covers recruiting and payroll in the UAE and abroad, plus a helpful team on call?

Try Bolto.

Top 15 Payroll Software in the UAE

Now that the key payroll considerations are clear, this section maps the UAE landscape with 15 platforms, spanning EOR specialists to full HCM suites, used by startups, SMEs, and enterprises. They’re grouped here because each tackles UAE-specific needs like WPS-compliant bank files, end-of-service gratuity, and bilingual workflows, while differing in scale, integrations, and pricing. Use this shortlist to quickly match your company’s size, compliance requirements, and growth plans. If you’re evaluating beyond the UAE, see our guide to the best global payroll services.

1. Bolto Global EOR (Employer of Record)

Bolto is an AI-powered global platform that unifies recruiting, payroll, HR, and EOR/contractor management across 150+ countries. For UAE headcount, it acts as your Employer of Record, issuing compliant local contracts and running payroll on your behalf. Public docs don’t spell out UAE-first staples like WPS/SIF or EOSB calculators, so it’s wise to confirm MOHRE alignment, Arabic/English documentation, and UAE bank connectivity during scoping.

UAE payroll highlights

- Hire in the UAE via EOR: compliant contracts, onboarding, benefits administration, and monthly payroll.

- Pay employees and contractors together with local-currency payouts, payslips, receipts, and payment-status tracking.

- Multi-currency and FX support with scheduled runs, approvals, and guardrails across countries.

- Self-service HR, leave, and configurable workflows; core HRIS profiles and onboarding included.

- Centralized reporting, exports, and dashboards; integrations with accounting, ATS, HRIS, and API.

- UAE specifics to validate: WPS/SIF processing, EOSB/gratuity handling, MOHRE timelines, and direct UAE bank rails.

Pricing snapshot

From USD 29 per employee/month for owned-entity payroll; EOR reportedly from USD 599 per employee; contractors from USD 599; monthly billing via sales; demo required; confirm final pricing and fees.

Best fit

Best for seed–Series A US startups expanding into the UAE via EOR while paying contractors; consider UAE-first payroll if you need native WPS/SIF, Arabic payslips, or automated EOSB.

2. HR Chronicle

Born in the UAE with Dubai-based support, HR Chronicle brings one-click payroll and GCC labor law nuance into a single HR/payroll platform. It generates MOHRE-compliant WPS/SIF files, supports 40+ UAE bank formats, and handles EOSB/gratuity with multi-currency across GCC entities. English comes standard; confirm Arabic availability. It’s software (not EOR), with optional payroll outsourcing locally via Payroll Ace.

UAE payroll highlights

- WPS/SIF automation with MOHRE compliance; 40+ UAE bank formats and automated uploads.

- End-of-service benefits: gratuity accruals, final settlements, and DIFC DEWS file configuration.

- Multi-currency, multi-company payroll across UAE/KSA/Oman; FX updates and KSA GOSI support.

- Employees and contractors in one run; mobile ESS, geo-fenced attendance, and approvals.

- Core HRIS and onboarding: offers, checklists, document vault, visa/passport expiry alerts.

- Integrations and accounting handoff: GL exports, ERP mappings, configurable analytics/reports.

- Security and role-based access; data-residency options; GCC multi-country compliance.

Pricing snapshot

From AED 100/month for up to 5 employees; larger tiers quote-based; monthly or annual billing; 14-day free trial; no EOR.

Best fit

Best for UAE/GCC SMBs to mid-market teams needing WPS automation, EOSB, and multi-entity payroll with Dubai support; consider alternatives if you require true EOR or guaranteed Arabic interface.

3. DelicateSoft (EasyHR)

EasyHR by Delicate Software Solutions is a UAE-built HR and payroll platform in cloud and desktop editions, designed around local rules and real-world bank file nuances. It automates WPS/SIF salary files for UAE banks and exchanges, calculates EOSB and Emirati pensions, supports Arabic/English, and aligns with MOHRE requirements. It serves in-house UAE employers (not an EOR) and adds document-expiry reminders to stay audit-ready.

UAE payroll highlights

- WPS/SIF automation across UAE banks and exchanges with preloaded routing codes and emailed payslips.

- End-of-service gratuity and final settlements per UAE Labour Law; Emirati pension contributions supported.

- Multi-currency payroll calculations and reporting, with WPS disbursements issued in AED.

- Employee Self-Service web and mobile; manager approvals for leave, loans, advances, expenses, payslips.

- Core HRIS covering employee records, visa/passport/Emirates ID expiry alerts, and local leave policies.

- Deployment flexibility: cloud subscription or on-prem desktop; role-based access; extensive reports.

Pricing snapshot

Pricing on request; desktop sold as multi-user licenses, cloud by subscription; free demo; no EOR; monthly or annual billing.

Best fit

Best for UAE SMEs to mid-market teams needing dependable WPS payroll, EOSB, ESS, and local HR workflows; consider alternatives if you require global EOR coverage or deep third-party integrations.

4. Bayzat

Built in the UAE with UAE-hosted data, Bayzat blends HR, payroll, and benefits into a sleek, region-ready experience. It automates WPS payroll with SIF generation, supports MOHRE, EOSB and DEWS, offers English/Arabic, and pays via UAE banks and exchange houses like Lulu Exchange. Bayzat is for direct employers (no EOR), with contractor payouts routed through an AP module.

UAE payroll highlights

- WPS automation with compliant SIF files for MOHRE, plus disbursement via Lulu Exchange.

- EOSB and settlements: gratuity per UAE labour rules, leave encashment, liability exports.

- DEWS support for DIFC entities with compliant contribution reporting.

- Multi-currency payroll tables and FX; map to accounting base; pay via domestic or overseas banks.

- Employees and contractors in one run: reimbursements, vendor invoices, TransferMate FX, MFA-secured payouts.

- Self-service mobile app for payslips, time-off, attendance; approvals, geo-fenced check-ins, integrations, analytics, ISO/SOC 2.

Pricing snapshot

Custom, quote-based pricing per employee/month; no public starting price; monthly or annual contracts by quote; request a demo for minimums and implementation fees; no EOR.

Best fit

Best for UAE/GCC startups and mid-market teams needing WPS automation, EOSB/DEWS, bilingual UX, and accounting/AP integrations; consider alternatives if you require global EOR/visa sponsorship or complex multi-country payroll.

5. DotsHR (dotshr)

DotsHR is a MENA-built HRMS and payroll suite that speaks UAE/GCC compliance fluently. It automates MOHRE-aligned WPS with SIF bank files, handles EOSB/gratuity and final settlements, supports Arabic/English across multi-company structures, and connects to UAE banks. It’s HR software (not an EOR) with cloud and on-premise options that help satisfy data-residency needs.

UAE payroll highlights

- WPS/SIF generation and automated, MOHRE-compliant bank uploads via UAE banks, including bulk.

- EOSB provisioning, accurate gratuity formulas, final settlements, and auditable payroll ledgers.

- Multi-company, multi-location payroll with approvals, off-cycle runs, timesheets, overtime, loans, and biometric attendance sync.

- Employee self-service for leave, requests, payslips; manager workflows, reminders, optional WhatsApp bot.

- Core HRIS and onboarding, document-expiry alerts, and 60+ built-in HR/payroll reports with dashboards.

- ERP/biometric integrations (SAP, Oracle, Navision); GCC coverage—UAE, KSA, Qatar, Oman; cloud or on-prem residency.

Pricing snapshot

Quote-based cloud or on-prem licensing; legacy packages from USD 933/year (Professional) and 1,999/year (Ultimate); setup fees/minimums; free demo; no EOR.

Best fit

Best for UAE/GCC SMEs to mid-market firms needing WPS, EOSB, Arabic/English UI, multi-entity payroll, and on-prem options; consider alternatives if you require EOR or broad contractor payment networks.

6. ubiHRM / UBIQHR

UBIQHR is a Dubai-based cloud HR/payroll suite that covers Core HR, attendance, leave, and payroll in one place. Its UAE payroll localizes for the Wage Protection System with SIF file generation, links to leading UAE money exchanges, automated EOSB, and multi-currency pay. English UI is available; Arabic isn’t explicitly listed. It’s HRIS/payroll, with no Employer of Record services.

UAE payroll highlights

- WPS/SIF automation with MOHRE-compliant Salary Information Files and connections to money exchanges.

- End-of-service benefits automation for gratuity and accruals at separation.

- Multi-currency support and multiple payrolls per period; allowances, off-cycle, segmented pay groups.

- Employee self-service with mobile payslips, reimbursements, overtime approvals, and workflows.

- Core HRIS plus time/attendance: records, documents, letter management, 3D facial recognition, instant reports.

- Integrations and configurable analytics reports.

Pricing snapshot

Quote-based; per-employee rates not public. Monthly subscriptions; free trial/demo. No EOR pricing since EOR isn’t offered.

Best fit

Best for UAE SMEs to mid-market teams needing all-in-one HRIS + payroll with WPS/SIF and EOS automation; consider alternatives if you require EOR coverage or in-country data residency guarantees.

7. Oracle (Fusion Global Payroll – UAE)

Oracle Fusion Cloud Payroll for the UAE brings a mature payroll engine into Oracle Cloud HCM with in-country localization. Expect WPS/SIF generation with MOHRE employer mapping, EOSB/gratuity, Emirati pensions (GPSSA/ADPF), and UAE bank/EFT flows, all under Oracle’s enterprise security and governance. It’s payroll software (not EOR); contractor payouts typically route via Oracle Financials or partners. Arabic and English are supported.

UAE payroll highlights

- WPS/SIF automation and MOHRE compliance: generate SIF, map multiple employer IDs, handle refunds.

- EOSB/gratuity: delivered rules via End of Service calculation card; override for special cases.

- Emirati pensions and GCC nationals: GPSSA/ADPF and GCC social insurance with a dedicated card.

- Multi-currency and FX; legislative currency on payslips; default TRUs and robust retro logic.

- Self-service and approvals: Redwood UX, Payroll Activity Center, exceptions, prepayments, payslips, accounting.

- Integrations/security: Oracle Financials posting, HCM Extracts/REST, third-party connectors; UAE OCI regions.

Pricing snapshot

Quote-based SaaS add-on to Oracle Cloud HCM; annual contracts; pricing varies by headcount/modules; no free trial (live demo available); implementation fees and minimums typically apply.

Best fit

Best for mid-size to large UAE/GCC employers already on Oracle HCM/ERP needing in-house localization; consider alternatives if you require EOR/contractor payouts in one tool or SMB-friendly standalone payroll.

8. Ramco

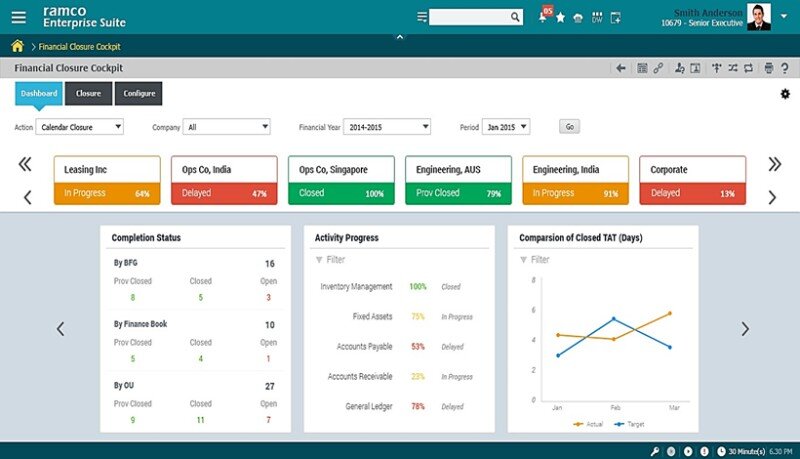

Ramco Payce (Ramco Global Payroll) is an enterprise, multi-country payroll platform with a deep Middle East footprint. In the UAE, it localizes payroll with native WPS/SIF, automated EOSB, and MOHRE-aligned updates, covering the 2023 alternative EOSB savings scheme. With Arabic/English UX and GCC coverage, Ramco offers software or managed payroll (not EOR) to scale complex operations.

UAE payroll highlights

- WPS/SIF automation with UAE bank-specific formats to reduce rejections and penalties.

- EOSB calculations and gratuity rules, including the 2023 voluntary alternative savings scheme.

- Multi-currency payroll and FX across AED/SAR/USD consolidated in unified runs.

- Employees and contractors in one flow via Contract Workforce/Staffing for timesheets and payouts.

- Mobile self-service in Arabic/English for payslips, leave, expenses, approvals, and workflows.

- Integrations: Workday Global Payroll Connect, Oracle HCM, SAP/Kronos connectors, plus bank file outputs.

- Security and data residency: cloud, on-prem, or managed service.

Pricing snapshot

Quote-based software or managed payroll. Third-party directories cite from ~USD 8 per employee/month, but you should confirm this with Ramco. Annual or monthly terms; minimums apply; guided demos available; no EOR.

Best fit

Best for mid-market and enterprise teams across GCC needing UAE-grade WPS/EOSB compliance and Workday/Oracle connectivity; consider alternatives if you need an EOR to hire without a local entity.

9. Darwinbox

Darwinbox is an enterprise HCM suite with a fully localized GCC payroll, including a rich UAE build. It supports WPS with SIF preparation, EOSB calculations, MOHRE-aligned rules, and Arabic/English self-service, all tightly integrated with time, attendance, and HR workflows. It’s not an EOR, but it runs compliant payroll for employees, contractors, and gig workers in your UAE entity.

UAE payroll highlights

- WPS compliance with SIF-ready outputs and pre-payroll validations to reduce bank rejections.

- EOSB calculation and final settlement workflows aligned to UAE labor law timelines.

- GPSSA and GCC social security contributions handled with localized rules.

- Unified HR, attendance, overtime, and leave feed payroll; e-approvals streamline review cycles.

- Employees and contractors in one run, configurable pay groups, off-cycle payments.

- ERP/accounting integrations and GL exports; analytics and in-region data residency.

Pricing snapshot

Custom, quote-based pricing (typically per employee/month) on annual agreements; demos available; no public self-serve rates.

Best fit

Best for UAE and GCC enterprise teams wanting unified HRIS plus localized payroll; consider alternatives if you require EOR hiring in the UAE without a local entity.

10. Keka

Keka is a cloud HR and payroll platform tuned for UAE/GCC realities like WPS/SIF generation, EOSB/gratuity, GPSSA, and bank-ready files, all wrapped in a modern, mobile-first experience. It supports Arabic/English UI and integrates with popular ERPs/accounting tools. For global hiring, Keka surfaces contractor payments and an EOR path via the Omnipresent marketplace (itself not the legal employer in UAE).

UAE payroll highlights

- WPS/SIF automation with MOHRE compliance; generate compliant files and automate uploads to UAE banks/exchanges.

- End-of-service benefits: built-in gratuity rules, calculators, eligibility caps, and audit trails.

- Multi-currency pay and FX; run employees and contractors together with maker-checker approvals.

- Core HRIS, onboarding, leave/attendance, timesheets, expenses, loans; Arabic self-service via web/mobile.

- Integrations: Xero, QuickBooks, Zoho Books, SAP, Odoo, Focus; open APIs and marketplace apps, including Omnipresent EOR.

Pricing snapshot

From $199/month for up to 50 employees in the UAE, then $4 per additional employee; free trial; nominal setup fee; monthly or annual billing; EOR priced separately via Omnipresent.

Best fit

Best for UAE/GCC SMBs to mid-market teams wanting compliant WPS payroll with Arabic support and modern HRIS; consider alternatives if you require in-house EOR or direct bank integrations.

11. greytHR

greytHR’s Middle East edition covers payroll, leave, attendance, and core HR with a UAE-ready layer. It automates WPS via SIF file generation, supports EOSB/gratuity and final settlements, and provides Arabic/English interfaces with UAE-bank flows, keeping pace with MOHRE updates. It’s software only (not EOR) and doesn’t natively pay contractors.

UAE payroll highlights

- WPS automation with UAE SIF file generation, guided payroll steps, and bank upload options.

- EOSB/gratuity calculations, leave encashment, and full-and-final settlements per UAE rules.

- Multi-country GCC coverage for UAE, KSA, Qatar, Bahrain, Oman, Kuwait with unified reporting.

- Self-service web/mobile for payslips, reimbursements, helpdesk, approvals; Arabic support in mobile app.

- Core HRIS, onboarding/offboarding, leave and attendance; configurable MIS reports and Analytics Hub.

- Integrations with Zoho People/Books, Tally, QuickBooks Online, open APIs; ISO 27001/SOC 2.

Pricing snapshot

From USD $50/month for 10 employees; +$2–$5 per additional employee. Monthly or annual billing (discounts available); 7-day free Enterprise trial; no EOR.

Best fit

Best for UAE/GCC SMEs to mid-market teams needing cost-effective, WPS-compliant payroll plus core HR; consider alternatives if you need global EOR coverage or native contractor payouts.

12. factoHR

factoHR is an AI-powered HRMS and payroll suite with mobile self-service that consolidates core HR, attendance, and payroll for GCC teams. In the UAE, it brings MOHRE/WPS compliance, SIF generation for banks/exchanges, Arabic/English payslips, and automated EOSB calculations. It’s software (not EOR), with off-cycle payouts usable for contractor disbursements inside your entity.

UAE payroll highlights

- WPS/SIF automation with bank templates and guidance for secure, compliant uploads.

- EOSB calculators, final settlements, and gratuity rules for accurate offboarding.

- Multi-currency support and FX; employees and contractors in one pay run.

- Self-service portal and mobile app for payslips, requests, approvals, and time-off.

- Core HRIS and onboarding unified with attendance, overtime, and payroll processing.

- Integrations with Tally, QuickBooks, Xero, SAP, Oracle, SuccessFactors, and SSO.

- Cloud security with encryption and SOC 2; multi-entity GCC coverage and analytics.

Pricing snapshot

UAE pricing is custom; free trial available. India reference starts at ₹4,999/month for up to 50 employees (then ₹69 per additional); add-ons often quarterly; monthly/annual options; no EOR.

Best fit

Best for UAE SMBs and US startups needing WPS-compliant payroll plus HRIS/ESS; consider alternatives if you require full EOR hiring or highly complex multi-country GCC statutory flows.

13. kpi.com

kpi.com is an all-in-one cloud suite (including HRIS, payroll, accounting, projects, documents, and reporting) built for UAE/GCC operators. It offers Arabic/English interfaces, MOHRE-aligned rules, WPS-ready payroll with UAE bank fields, and EOSB calculators for limited/unlimited contracts. Not an EOR, it pays employees via Payroll and handles contractors in Accounts/AP for clean audit trails.

UAE payroll highlights

- WPS/SIF readiness: capture IBAN, SWIFT, and UAE bank codes; confirm automated SIF export in trial.

- EOSB calculators for limited/unlimited contracts, resignation/termination scenarios per MOHRE.

- Multi-currency payroll with FX; AED/USD/EUR; employees + contractors unified in finance workflow.

- Employee self-service for documents, time-off, expenses; configurable multi-step approvals.

- Integrations: native Accounts/AP, payroll-to-ledger sync; reports, dashboards, VAT views.

- Security on AWS with 256-bit SSL, IP allow-listing, backups, GDPR; GCC multi-country support.

Pricing snapshot

Modular, quote-based pricing; 14-day free trial (no card); optional implementation/support/custom PDFs; monthly or annual billing; software only (no EOR).

Best fit

Best for UAE/GCC SMBs and seed–Series B startups wanting an Arabic/English all-in-one HR, payroll, and accounting stack; consider alternatives if you require automated SIF plus UAE bank integrations.

14. ZingHR

ZingHR is a multilingual HCM and payroll suite with hire-to-rehire workflows that extend from core HR to time and pay. For the UAE/GCC, it supports WPS compliance, SIF file generation, EOSB handling, and statutory readiness, with optional UAE hosting and a Dubai Internet City office. It isn’t an Employer of Record; you’ll need a local entity, though managed payroll can cover contractors.

UAE payroll highlights

- WPS/SIF file generation and automated bank uploads for on-time salary disbursements.

- EOSB and full-and-final settlements with configurable gratuity rules and workflows.

- Multi-currency payroll and FX; pay employees and contractors in a single run.

- Employee self-service, approvals, mobile payslips; multilingual app for Arabic/English teams.

- Core HRIS and onboarding unified with payroll; dashboards and configurable analytics.

- API integrations with ERPs/HRIS (Xero, SAP SuccessFactors, Oracle) plus custom connectors.

- Security/data residency with UAE hosting on Azure; ISO-27001 and GDPR measures; GCC compliance.

Pricing snapshot

Quote-based (no public AED per-employee pricing). Annual subscriptions auto-renew; mid-term fees non-refundable; 15-day notice to cancel; free demo.

Best fit

Best for mid-market and enterprise teams across the UAE/GCC needing WPS-compliant payroll with HRIS and hosting; consider alternatives if you require true EOR hiring or transparent SMB pricing.

15. Spine Payroll / Spine HR

Spine HR Suite, marketed in the UAE via local partners, delivers HRMS and payroll localized for MOHRE. Expect WPS/SIF generation, configurable EOSB gratuity, visa and Emirates ID reminders, and cloud or on-prem deployments. The interface supports English/Hindi (no Arabic), and it’s software only; contractors can be paid through standard payroll runs.

UAE payroll highlights

- WPS/SIF automation and UAE bank upload workflows to meet MOHRE requirements.

- EOSB and full-and-final settlement calculators aligned with UAE gratuity rules and service brackets.

- Multi-company, multi-branch controls; emerging GCC multi-country payroll for regional growth.

- Employee self-service, approvals, attendance, and biometric devices to streamline payroll cycles.

- Core HRIS spanning recruitment, onboarding, leave, payroll; configurable analytics and reports.

- Integrations for Tally/ERP, time and attendance, and bulk Excel imports via UAE partners.

Pricing snapshot

Quote-based via UAE partners; cloud subscriptions per employee with annual billing; on-prem/perpetual licenses available; free demos; minimums vary.

Best fit

Best for UAE SMEs to mid-market teams needing WPS-compliant payroll with local partner implementation; consider alternatives if you require Arabic UI, EOR hiring, or advanced multi-currency automation and payouts.

Pricing and typical costs in the UAE

Software pricing varies by headcount, features, and whether you include HR modules or EOR. For ballpark numbers, see Bolto pricing. Expect the following patterns for payroll software uae plans:

- Per employee per month license for core payroll and WPS features

- Setup fees for bank connectivity and SIF mapping

- Add ons for attendance, leave, and performance

- Optional EOR or contractor modules if you hire outside the UAE

Banks and exchanges also charge to process WPS files. For example, one major bank lists a per file fee and a small per employee record fee for business online submissions. These charges are usually subject to VAT. (emiratesislamic.ae) For a deeper breakdown of vendor pricing models, read our payroll services pricing guide.

Implementation and integration checklist

Use this step by step plan to deploy payroll software uae without drama.

Plan and prepare

- Confirm MoHRE establishment IDs, employee labour card numbers, and bank or exchange relationships

- Map basic pay versus variable pay so SIF fields are accurate

- Decide payroll calendar and cutoffs that avoid the day 15 late threshold (uabwps.com)

Configure and test

- Set gratuity rules that rely only on basic salary

- Upload historical balances and validate totals

- Generate a test SIF with a small batch and reconcile against bank validations before go live (thenationalnews.com)

Go live and monitor

- Run parallel for one cycle

- Submit SIF early to catch rejections

- Store confirmations and reports for audits and for the seven year corporate tax record rule (tax.gov.ae)

If you prefer a guided rollout and a single vendor for recruiting plus payroll, book a demo with Bolto.

Security and data privacy considerations

Regulations you must align with

- PDPL for companies in mainland UAE including rules for cross border transfers and data subject rights

- DIFC or ADGM data protection frameworks if you operate in those free zones (u.ae)

Software and process controls

- Encryption in transit and at rest with regional hosting options

- Role based access with logs for all payroll changes

- Vendor data processing terms that reference PDPL and, where relevant, DIFC or ADGM rules

- Tested backups and disaster recovery

- Data minimization so SIF files include what is required and nothing more

For teams that also recruit globally, Bolto adds global compliance guardrails with dedicated human support.

Conclusion

Payroll software uae should make WPS submission routine, calculate gratuity correctly, and keep you ready for MoHRE checks and nine month corporate tax deadlines. Pick a system that generates clean SIF files in AED, validates totals and allowances, and stores audit proof records for at least seven years. That way, your people are paid on time and your finance team sleeps better.

Looking for one stack that covers recruiting, UAE payroll, and global EOR with founder friendly support?

Visit Bolto. See how Rebet built a full engineering team with Bolto in under five weeks.

FAQs

What is WPS and why does payroll software uae need it

WPS is the nationwide system that tracks private sector wage payments through banks and exchanges under MoHRE and the Central Bank. Payroll software uae should generate SIF files with EDR and SCR records for compliant submissions. (centralbank.ae)

When is a salary considered late in the UAE

If wages are not paid within 15 days after the due date, the employer is considered late and enforcement steps can follow, including blocks on new work permits. (mohre.gov.ae)

How is end of service gratuity calculated

For private sector employees under MoHRE, gratuity is based on basic salary only. It is 21 days per year for the first five years and 30 days for each year after that, with a cap of two years of basic salary. Payroll software uae should calculate this automatically. (thenationalnews.com)

What corporate tax items affect payroll records

Corporate tax applies at 9 percent for financial years beginning on or after June 1 2023. Returns are due within nine months and records must be retained for at least seven years after each tax period. Ensure payroll reports and confirmations are archived accordingly. (mof.gov.ae)

Do Dubai and Abu Dhabi require employer health insurance

Yes, Dubai and Abu Dhabi require sponsor or employer provided health insurance, with implementing rules under DHA and the Abu Dhabi Department of Health. Payroll software uae should track eligibility and allowed deductions. (dlp.dubai.gov.ae)

Which banks and file formats should be supported

Support SIF files that follow Central Bank and MoHRE formatting, with AED as the payment currency, and have profiles tested with your bank or exchange house. (uabwps.com)

Does PDPL affect how payroll data is stored

Yes. PDPL sets principles for processing, data subject rights, and conditions for cross border transfers. If you operate in DIFC or ADGM, their data protection laws apply in those jurisdictions. Choose payroll software uae with strong privacy controls and clear data processing terms. (u.ae)

Can one vendor handle recruiting, payroll, and EOR

Yes. Platforms like Bolto combine recruiting, UAE payroll with WPS, global contractor payments, and EOR so you can hire, pay, and stay compliant from one place.