Top 15 Payroll System Philippines Picks (2026 Guide)

Choosing the right payroll system philippines can be the difference between smooth monthly runs and stressful fire drills. The best system is one that aligns with your company’s size, compliance needs, and existing HR tools. If you hire or plan to hire in the Philippines, you face statutory updates, changing tax tables, and strict reporting windows. This guide covers what compliance really requires, how to evaluate vendors, when to outsource, what implementation looks like, and where global reporting fits. Along the way you will find verifiable facts and a clear framework to help you decide.

Philippine payroll compliance 101

Getting payroll right in the Philippines means mapping each statutory pillar, then automating the edge cases.

- Social Security System contributions moved to a total rate of 15 percent effective January 1 2025, split 10 percent employer and 5 percent employee, with a monthly salary credit range of 5,000 to 35,000 and a small Employees Compensation add on paid by the employer. (sss.gov.ph)

- PhilHealth kept the premium rate at 5 percent for 2025, with an income floor of 10,000 and a ceiling of 100,000 per month. (philstar.com)

- Pag IBIG doubled the maximum regular monthly savings to 200 for the employee and 200 for the employer starting February 2024 by raising the compensation cap used in the two percent computation to 10,000. (mirror.pia.gov.ph)

- Thirteenth month pay is mandatory for rank and file employees and must be released on or before December 24, with a minimum equal to one twelfth of basic salary for the year. No exemptions are allowed and compliance reporting is required each January. (pna.gov.ph)

- Withholding on compensation uses the TRAIN reduced rates from January 1 2023 onward, which lowered brackets and increased take home pay for many employees. (mirror.pia.gov.ph)

- BIR Form 1601C for monthly withholding on compensation is generally due on or before the tenth day of the following month, with eFPS filers getting an additional five days based on group schedule. (efps.bir.gov.ph)

- Employers must use SSS Payment Reference Numbers for real time posting and can manage electronic collection lists in the SSS portal. (sss.gov.ph)

- PhilHealth EPRS is the employer portal for enrollment, reporting, and e payments through partner banks. (philhealth.gov.ph)

A payroll system philippines should encode these rules out of the box, then surface what needs manual review.

Risks of manual or outdated payroll systems

Manual spreadsheets or aging tools introduce silent risks that escalate.

- Late or under remitted SSS can trigger interest of two percent per month and even criminal liability for responsible officers in serious cases. (lawyer-philippines.com)

- PhilHealth treats a fraction of a month late as a full month for interest, with up to three percent per month allowed by law. (elibrary.judiciary.gov.ph)

- Pag IBIG enforces Circular 460 and publicly reminds employers that failure to implement the new 200 share will be penalized. (pia.gov.ph)

- Data breaches of payroll files must be reported to the National Privacy Commission and affected individuals within seventy two hours, so unsecured spreadsheets create regulatory exposure. (privacy.gov.ph)

The right payroll system philippines reduces these risks with built in validations, cut off reminders, and statutory updates you do not have to chase.

Key selection criteria for a Philippine payroll system

Use this checklist to compare vendors.

- Compliance depth, current SSS 15 percent rate with new salary credit ceiling, PhilHealth 5 percent with 100k ceiling, Pag IBIG Circular 460 handling, and TRAIN withholding tables. (sss.gov.ph)

- Filing workflows, eFPS and eBIRForms exports for 1601C, relief for group deadlines, and pre built alphalists. (efps.bir.gov.ph)

- Government integrations, SSS PRN generation, PhilHealth EPRS files, and bank partners. (sss.gov.ph)

- Controls and audit, maker checker approvals, amendment logs, and variance flags for net pay swings.

- Data privacy, encryption at rest and in transit, breach playbooks tuned to the NPC seventy two hour rule, and role based access. (privacy.gov.ph)

- Support and updates, how fast new circulars are shipped into the product and how quickly you get human help during cutoffs.

If your headcount spans the United States and the Philippines, consider platforms that also handle US payroll and contractor payouts in one flow. Bolto offers unified employee and contractor pay plus global EOR if you plan to scale beyond one country.

Total cost of ownership and expected ROI

Price tags rarely show the full cost. Factor in:

- Setup, data migration, and parallel run effort over two to three cycles

- Yearly changes like SSS and PhilHealth adjustments that demand configuration time, which a modern payroll system philippines should automate for you

- Penalty avoidance savings from on time and accurate filings, for example SSS interest at two percent per month and PhilHealth interest up to three percent per month can swamp license fees if mistakes compound (lawyer-philippines.com)

- Team time saved on 1601C prep, SSS PRN runs, and EPRS uploads when your reports export cleanly to government formats (efps.bir.gov.ph)

Many companies see payback in one to three quarters once penalties and manual hours drop.

When to choose outsourcing vs. software (or both)

- Choose software if you have stable monthly cycles, an internal preparer, and want control with audit trails. A strong payroll system philippines keeps you fast and compliant without agency fees.

- Choose outsourcing if you have complex retro pay, frequent hires and exits, or limited in house capacity during year end.

- Combine both when you want software for daily operations plus an EOR or contractor of record for cross border hiring.

If you plan to hire in multiple countries or need an EOR for employees outside your entities, consider Bolto. You can run US payroll and contractor payments, then add EOR in over one hundred countries as you expand, while keeping one system of record.

Top 15 Payroll Systems in the Philippines

Building on the essentials, this section spotlights 15 standout payroll platforms used by Philippine organizations, from homegrown providers to regional and global suites. Grouped for their strengths in local compliance (BIR, SSS, PhilHealth, Pag-IBIG), automation breadth, and scalability, these options help teams reduce manual work and payroll errors as they grow. Use this shortlist to quickly narrow candidates before deeper feature and pricing evaluations.

14. KPMG Philippines (R.G. Manabat & Co.)

KPMG Philippines delivers payroll outsourcing through its tax and global compliance teams, operating on KPMG LINK Global Payroll. Expect end to end services, including gross to net, BIR filings, SSS/PhilHealth/Pag IBIG remittances, 13th month, and DOLE aligned OT/night diff, while USD funding/FX happens via your banking rails and payouts occur in PHP.

What US‑to‑Philippines teams get

- PH payroll and statutory filings managed for you (BIR alphalists, SSS, PhilHealth, Pag‑IBIG).

- Employee‑first coverage; contractors/EOR by arrangement; not a self‑serve platform.

- Multi‑currency coordination: USD funding, FX at your bank; PHP net pay and remittances.

- Integrations with major payroll vendors; exports for Xero/QBO/NetSuite; HRIS data ingestion.

- KPMG security/governance, approvals, RBAC, and audit trails.

- Reports, dashboards, reconciliations; checklists; attendance ingestion from client tools.

Fit and pricing

Best for US companies with a PH entity seeking Big Four oversight and tax rigor. Starting price: Contact sales.

Trade‑offs

- Not self‑serve software.

- Longer implementations and change control.

- Higher fees than SMB payroll apps.

1. Sprout Solutions

Built in the Philippines for Philippine companies, Sprout is a full HRIS + payroll suite that keeps pace with local law. Expect auto updated BIR tables, SSS/PhilHealth/Pag IBIG computations, 13th month pay, and OT/night differential baked in. It generates PHP bank, GCash, and PESONet disbursement files, and most firms fund locally and run payouts in country.

What US‑to‑Philippines teams get

- Up‑to‑date PH payroll automation and filings (BIR 2316/1601‑C, SSS, PhilHealth, Pag‑IBIG) with year‑end annualization.

- Systemized 13th‑month, OT, night differential, holiday and final pay.

- Employee and contractor support, plus payroll outsourcing; APIs for custom flows.

- Local disbursements (PH bank files, GCash Biz, PESONet) with PHP payroll runs.

- Integrations via GL exports/APIs with Xero, QBO, NetSuite, and HRIS tools.

- Security: ISO 27001, MFA/SSO, role‑based access, audit logs; Azure hosting.

- People analytics with attendance, time‑off, onboarding powered by Sprout HRIS.

Fit and pricing

Best for US startups operating a PH entity that want a native, end‑to‑end suite. Starting price: Contact sales; payroll outsourcing from ₱7,900/month (up to 10 employees).

Trade‑offs

- No native EOR.

- Deeper accounting/HRIS integrations may rely on exports/APIs.

2. JustPayroll.ph

A long standing PH payroll brand now under Sprout Solutions, JustPayroll.ph focuses on compliant, end to end Philippine payroll. It automates BIR filings (1601 C, 1604 CF, 2316), SSS/PhilHealth/Pag IBIG reporting, and handles 13th month, OT, and night differential, exporting bank/GCash payout files while funding and FX typically happen outside the system.

What US‑to‑Philippines teams get

- PH statutory automation with BIR alphalists/2316s and detailed audit trails.

- Employee and contractor support; EOR handled via partners/adjacent providers.

- PHP payroll with bank DAT files for major PH banks and GCash Biz.

- Payroll API and GL mapping/exports for Xero, QBO, NetSuite; webhook support.

- Role‑based access, SSO/MFA; self‑service payslips/2316; onboarding, leave, attendance.

- Reporting and analytics tuned for PH pay cycles.

Fit and pricing

Best for US firms with a PH entity seeking proven local payroll. Starting price: ₱7,900/month for 10 employees.

Trade‑offs

- Not an EOR.

- Accounting integrations often require API/GL setup work.

3. PayrollHero

Designed for PH entities, PayrollHero combines payroll, HRIS, and robust time/attendance for shift heavy teams. It automates BIR forms (1601 C, 2316, Alphalist), SSS/PhilHealth/Pag IBIG, 13th month, holiday rates, and BPO style overtime rules, outputting bank payroll files while you fund a local PH account.

What US‑to‑Philippines teams get

- PH payroll automation and BIR filings (1601‑C, 2316, DAT Alphalist); SSS R‑3/R‑1a, PhilHealth RF‑1/ER2, Pag‑IBIG FPF060.

- Employee/contractor support; no EOR.

- Local disbursement files for major PH banks; no built‑in FX.

- QuickBooks journal export; Xero/NetSuite via CSV; TeamClock/#MyClock apps.

- Security with 2FA, encryption, role‑based access; 99% uptime SLA.

- Dashboards, analytics, leave, scheduling, attendance, onboarding.

Fit and pricing

Best for US firms with PH entities that need tight payroll‑attendance control. Starting price: HRIS+Time $3.50/emp/mo; Payroll $3.00; Leave $2.00; 30‑day trial.

Trade‑offs

- No EOR.

- Requires a PH bank for payouts.

- Many ERP/HRIS integrations are CSV‑based.

4. ADP

ADP brings enterprise grade payroll to the Philippines via Celergo/GlobalView and local Vista HCM. It automates BIR 1601 C, SSS, PhilHealth, Pag IBIG, and standard PH premiums like 13th month and night differential (via SecurTime). Payment Support Services help manage FX and PHP disbursements; confirm e wallet coverage (GCash/Maya) during scoping.

What US‑to‑Philippines teams get

- PH statutory automation and filings with ongoing legislative updates.

- Employment payroll plus EOR path via marketplace partner G‑P if you lack an entity.

- Coordinated FX and PHP bank disbursements through ADP services.

- Integrations: NetSuite connectors, QBO GL export, APIs; links to Workday/Oracle.

- Security: SOC 1/2 Type 2, ISO 27001/27701; RBAC and audit logs.

- Multi‑country analytics; onboarding, time‑off, attendance (Vista + SecurTime).

Fit and pricing

Best for US firms with a PH entity wanting unified global payroll governance. Starting price: Contact sales.

Trade‑offs

- No native EOR (handled via partner G‑P).

- Heavier implementation and integration effort than SMB‑first tools.

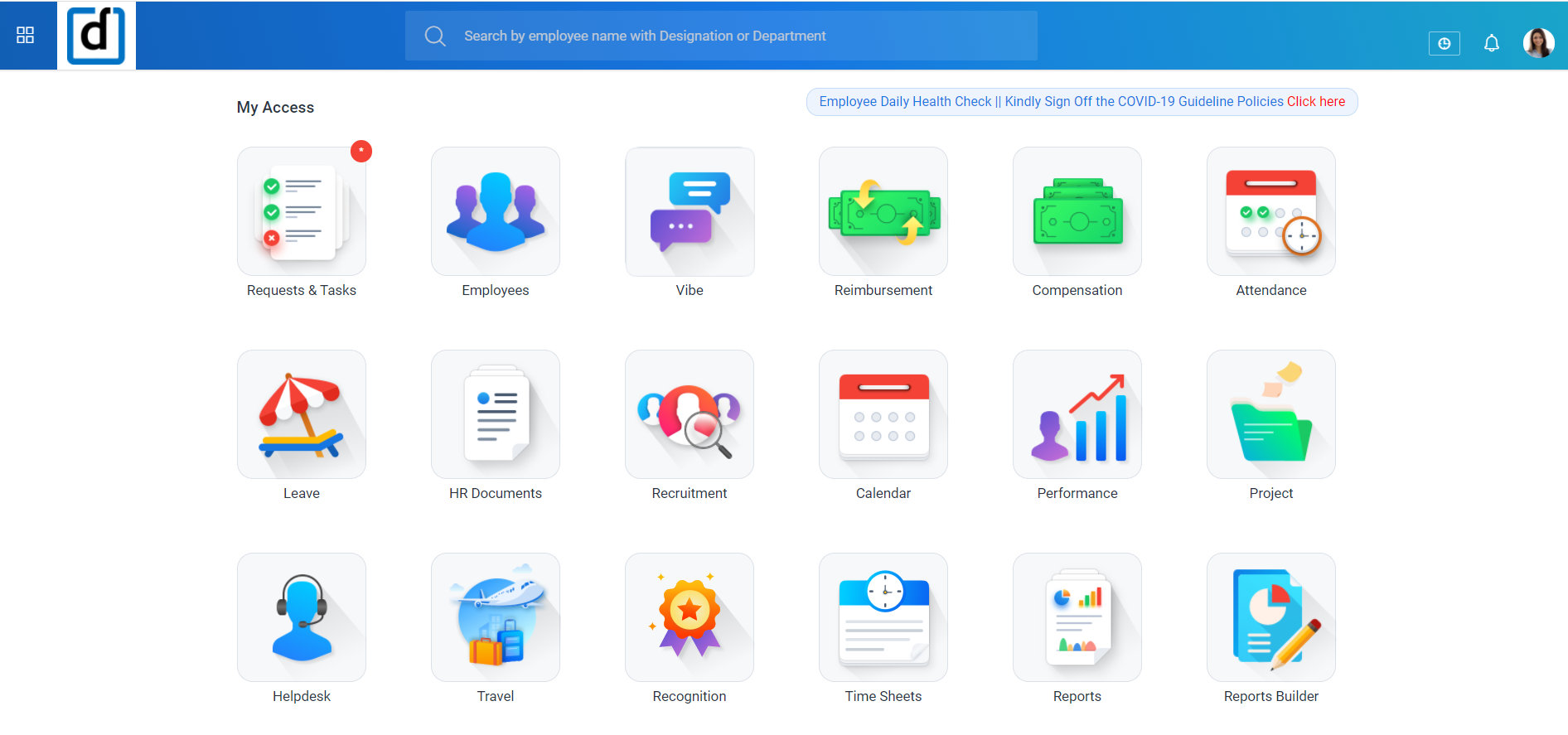

5. Darwinbox

Darwinbox is an enterprise HCM that introduced a native Philippines payroll engine in 2025, tying HR, time/attendance, and payroll together. It automates PH rules, including BIR withholding, SSS, PhilHealth, Pag IBIG, 13th month, and night diff/OT, while US to PH funds typically flow through your bank with payouts via local rails.

What US‑to‑Philippines teams get

- PH payroll automation with audit trails and year‑end reporting.

- Attendance‑driven OT/night differential and holiday logic flowing into payroll.

- Employees and contractors; no EOR—requires a PH entity or separate provider.

- PHP payroll with bank files; optional wallet rails via partners.

- Open APIs/iPaaS for HRIS/ATS and finance (NetSuite, Intacct, Xero, QBO).

- Enterprise security: ISO 27001/SOC 2, RBAC, approvals, audit logs, analytics.

Fit and pricing

Best for enterprises (500+) needing PH‑native payroll within a unified HCM. Starting price: Contact sales.

Trade‑offs

- New PH payroll—confirm bank file formats and rollout scope.

- Not an EOR; you’ll need your own entity or partner.

6. Ramco Systems

Ramco Payce is a multi country enterprise payroll and managed service proven at BPO scale in the Philippines. It addresses evolving PH rules (e.g., SSS 15% in 2025, PhilHealth 5%, Pag IBIG ₱200), BIR filings/alphalists, 13th month, and night diff/OT, with FX handled via your bank and payouts over InstaPay/PESONet.

What US‑to‑Philippines teams get

- Comprehensive PH statutory automation (BIR 1604‑C/F, 1601‑EQ/FQ, alphalists).

- Employees/contractors with optional managed payroll; EOR via separate provider.

- Multi‑currency setup; PHP disbursements through employer banks, InstaPay, PESONet.

- Connectors to Workday/Oracle/SAP/Kronos; files/APIs for Xero/QBO.

- ISO 27001, SOC 2 Type II, MFA, encryption, RBAC; analytics/dashboards.

- Onboarding, leave, timesheets, attendance integrated to payroll.

Fit and pricing

Best for large US employers with PH entities/BPO operations needing multi‑country scale. Starting price: Contact sales.

Trade‑offs

- Heavy implementation for SMBs.

- Not an EOR; pair with an employer‑of‑record if you lack a PH entity.

7. PeopleStrong

PeopleStrong is an APAC HCM/payroll platform for mid market and enterprise teams that ships with a PH payroll module. It automates BIR withholding/annual reports, SSS/PhilHealth/Pag IBIG remittances, 13th month, and overtime/night differential via integrated attendance; funding and local bank disbursements remain in your control.

What US‑to‑Philippines teams get

- PH statutory automation across semi‑monthly, monthly, and off‑cycle runs.

- Employee and contractor support; partner EOR as needed.

- Multi‑currency setup; bank files/H2H for local PH disbursements.

- Open APIs, SSO, and SFTP connectors; accounting syncs to Xero/QBO/NetSuite.

- Security: ISO/SOC assessed, maker‑checker approvals, RBAC, full audit logs.

- Analytics; mobile onboarding, leave, attendance; accurate OT/night diff rules.

Fit and pricing

Best for US startups with a PH entity that want a unified HCM plus compliant payroll. Starting price: Contact sales.

Trade‑offs

- No native EOR.

- Fewer US‑centric accounting/HRIS connectors out of the box.

- Bank‑only payout focus; confirm e‑wallet rails if required.

8. Omni HR

Omni HR is an Asia first HRIS with a native PH payroll module that ties core HR and time tracking to compliant pay runs. It covers BIR, SSS, PhilHealth, Pag IBIG, 13th month, OT, night diff, and holidays; US→PH teams can run PHP payroll, rely on contractors/EOR if needed, and route USD→PHP via banks.

What US‑to‑Philippines teams get

- PH payroll automation (BIR filings, SSS/PhilHealth/Pag‑IBIG, 13th‑month, OT/night diff).

- Employees, contractors, and access to EOR for hiring without a local entity.

- Multi‑currency/FX with local PH disbursements (banks; check GCash/Maya availability).

- Integrations: Xero native; journals export for QBO/NetSuite; Slack/Teams/Google.

- Security: SOC 2 controls, ISO 27001 hosting, AES‑256, RBAC, SAML SSO, audits.

- Analytics with scheduled reports; onboarding, leave, attendance aligned to DOLE.

Fit and pricing

Best for US startups hiring in PH that want HRIS‑led payroll with optional EOR. Starting price: Core HR $3/emp; PH payroll add‑on $2–4.

Trade‑offs

- Integration depth beyond Xero is not fully documented.

- Public details on PH e‑filings are limited—confirm during evaluation.

- EOR coverage varies by country; verify scope for PH.

9. peopleHum

peopleHum added a Philippines payroll module in 2025, extending its all in one HRIS with local compliance. It automates BIR filings and SSS/PhilHealth/Pag IBIG deductions, handles 13th month and overtime/holiday premiums, and links attendance to payroll; confirm night diff configurations and preferred payout rails.

What US‑to‑Philippines teams get

- PH statutory automation (BIR reports, SSS/PhilHealth/Pag‑IBIG), 13th‑month, OT/holiday multipliers.

- Employee/contractor support with partner EOR referrals if needed.

- Time, attendance, leave, and shifts that flow cleanly into payroll.

- Multi‑currency context; PH bank disbursements; check GCash/Maya support.

- Integrations via SSO, calendars, chat, biometric time; CSV + hub for accounting/HRIS.

- Security: ISO 27001 program, AWS hosting, RBAC; analytics and onboarding.

Fit and pricing

Best for US startups with a PH entity that prefer HRIS‑first payroll. Starting price: HR $2/emp/mo; payroll by quote.

Trade‑offs

- New PH module—expect maturing coverage and documentation.

- Public info on payout rails and deep integrations is thin.

10. ZingHR

ZingHR is a regional HRMS/payroll suite with managed payroll and multi country compliance, including the Philippines. Setup supports BIR, SSS, PhilHealth, Pag IBIG, 13th month, and OT/night diff rules. US→PH teams usually calculate in app and fund/disburse via PH banks.

What US‑to‑Philippines teams get

- PH statutory automation (BIR forms, SSS/PhilHealth/Pag‑IBIG, 13th‑month).

- Employee/contractor support and on‑ground payroll services; not an EOR.

- Multi‑currency setups; local bank file generation for payouts.

- REST APIs, Xero connectivity; SSO with Azure AD/ADFS/Okta.

- Security: ISO 27001, SSAE 18, ISO 9001; MFA, RBAC, audit trails.

- Workforce management: geofenced/face attendance, time‑off, analytics, Payroll Cockpit.

- Digital KYC, mobile onboarding, self‑service payslips.

Fit and pricing

Best for US startups wanting a unified HRMS with PH compliance and regional reach. Starting price: Contact sales.

Trade‑offs

- Not an EOR.

- Confirm PH e‑filing specifics and bank formats early.

11. PeopleApex

PeopleApex offers a configurable, multi country HRMS where Philippine payroll is built via rules and statutory data capture. It covers 13th month, OT/night diff, SSS, PhilHealth, and Pag IBIG with in country partner validation, running multi currency payroll and local bank credits; BIR e filing is not native.

What US‑to‑Philippines teams get

- PH statutory logic via a flexible rules engine (13th‑month, OT/night diff, SSS/PhilHealth/Pag‑IBIG).

- Employee/contractor support under your PH entity; self‑service onboarding/tax declarations.

- Multi‑currency payroll; local PH bank disbursements; FX via your bank/treasury.

- Time/leave/shifts and biometric/geotag attendance feeding payroll.

- APIs and file integrations for ERPs/HRIS; exports to QBO/Xero/NetSuite.

- Security: RBAC, audit trails, SSO; analytics and payroll MIS/reporting.

Fit and pricing

Best for US startups with a PH entity that want configurable payroll inside HRMS. Starting price: Contact sales.

Trade‑offs

- Requires partner validation; no native BIR e‑filing.

- Integrations often rely on API/CSV; confirm SOC/ISO attestations.

12. MSQUARE

MSQUARE is a cloud HRMS for SMBs with payroll, time, and core HR, but it isn’t localized for Philippine compliance out of the box. Teams must configure BIR, SSS, PhilHealth, Pag IBIG, and 13th month rules manually and file with agencies themselves; FX and payouts are handled externally via banks or wallets.

What US‑to‑Philippines teams get

- Manual PH setup for BIR/SSS/PhilHealth/Pag‑IBIG; configure 13th‑month, OT/night diff, and current contribution rates.

- Employees and contractors; software‑only (no EOR); optional outsourced processing.

- Multi‑currency modeled outside payroll; export salary sheets for local disbursements.

- Excel/CSV exports to Xero/QBO/NetSuite; verify any native connectors.

- Attendance, leave, onboarding, payslips; confirm SOC 2/ISO and audit logging.

Fit and pricing

Best for budget‑minded US teams handling PH compliance themselves. Starting price: ₹25,999/year for ≤50 employees.

Trade‑offs

- Not PH‑localized; agency filings are manual.

- Limited native integrations; no built‑in PH payout rails.

13. Resourceinn

Resourceinn bundles HRIS, time, and payroll for SMBs/mid market, with configurable logic for the Philippines. It can compute statutory deductions, 13th month, and OT/night diff from captured time, but public docs don’t confirm BIR/SSS/PhilHealth/Pag IBIG e filings; FX is supported, payout rails are not detailed.

What US‑to‑Philippines teams get

- Configurable PH payroll rules; verify BIR 1601‑C/2316 and SSS/PhilHealth/Pag‑IBIG outputs.

- Employee/contractor coverage; not an EOR.

- Multi‑currency payroll and automatic FX with multi‑company controls.

- Integrations: QuickBooks, Xero, Slack, Clockify, and 120+ apps.

- Security: ISO 27001/27701, encryption, RBAC, audit trails; GDPR/CCPA alignment.

- Reporting dashboards; leave, attendance, scheduling, mobile self‑service.

Fit and pricing

Best for SMBs that can configure PH payroll inside HRMS. Starting price: Contact sales.

Trade‑offs

- No turnkey PH compliance pack or e‑filings.

- Not an EOR; payout rails undisclosed.

- Default support SLAs may skew to off‑hours.

15. D&V Philippines

D&V Philippines is a Manila based finance BPO that runs managed payroll from onboarding to year end. It handles BIR withholding/certificates, SSS/PhilHealth/Pag IBIG schedules, 13th month, and DOLE aligned OT/night diff. US→PH clients typically fund externally; D&V prepares bank files and remittance instructions for local payouts.

What US‑to‑Philippines teams get

- PH statutory coverage: BIR withholding/certificates, 13th‑month, night diff, SSS/PhilHealth/Pag‑IBIG remittances.

- Employees and contractors; works with your PH entity or partner EOR for employment.

- FX coordination and local disbursement files (PH banks; GCash/Maya where supported).

- Integrations with Xero (Gold Partner) and QBO; adapts to NetSuite/HRIS/timekeeping.

- Security/quality program (ISO 9001:2015), RBAC, auditability; confirm SOC 2/ISO 27001.

- Custom reports and dashboards tailored to finance workflows.

Fit and pricing

Best for US startups that want a managed PH payroll back office while keeping accounting in Xero/QBO. Starting price: Contact sales.

Trade‑offs

- No EOR.

- Limited packaged integrations beyond Xero/QBO—expect custom mapping.

Implementation checklist and best practices

Treat implementation like a short project.

- Clean source data, legal names, TIN, SSS, PhilHealth, Pag IBIG numbers, and employment status

- Map pay items to TRAIN taxability and statutory bases before your first run (mirror.pia.gov.ph)

- Configure SSS 15 percent rates with the new salary credit limits, PhilHealth 5 percent with the current ceiling, and Pag IBIG 200 plus 200 shares, then validate with a sample set (sss.gov.ph)

- Align calendars to due dates, 1601C by the tenth or eFPS group schedule, PhilHealth and SSS cutoffs, and thirteenth month timelines before December 24 (efps.bir.gov.ph)

- Run two parallel cycles and reconcile variances at the pay element level

- Document controls and a breach response plan aligned to NPC reporting timelines (privacy.gov.ph)

If you need recruiting and onboarding alongside payroll, Bolto combines AI powered recruiting, EOR, and payroll so new hires land in payroll with correct statutory data on day one.

Advanced needs, multi entity and global reporting

Once you operate more than one entity, reporting moves from single country rules to management questions across currencies and calendars.

- Multi entity consolidation, standardize charts of pay items and statutory mappings so you can compare labor cost across the Philippines and the United States

- Global headcount and cost views, align exchange rate policies and show statutory contributions as separate lines for SSS, PhilHealth, and Pag IBIG

- Cross country hiring, add EOR or contractor management where you do not have entities, then feed one payroll data lake

Growing teams often pick a payroll system philippines for local accuracy, then add a global layer for analytics and hiring. Platforms like Bolto give you EOR coverage, contractor payments, and US payroll in one place so finance can report globally without stitching tools.

From back office to strategic enabler

A modern payroll system philippines does more than calculate net pay. It is how you control cash flow, reduce penalties, and support fast hiring. The SSS increase that extends fund life to 2053 and the PhilHealth and Pag IBIG updates prove rules will keep moving, so your tooling must keep pace. (sss.gov.ph)

Conclusion

Payroll in the Philippines rewards teams that automate the rules and tighten controls. If you select a payroll system philippines that updates itself for statutory changes, exports clean files for BIR and government portals, and gives you strong approvals and logs, you can move from rework to reliability. If you also need to hire quickly across borders, unify payroll with recruiting and EOR so headcount and compliance live in one place. See how that looks in practice with Bolto.

FAQ: Payroll system Philippines

What are the most important statutory settings a payroll system philippines must have in 2026

It must reflect SSS at 15 percent with the updated salary credit range, PhilHealth at 5 percent with a 100k income ceiling, and Pag IBIG at 200 each for employer and employee, plus TRAIN withholding tables effective 2023. (sss.gov.ph)

When is thirteenth month pay due in the Philippines

On or before December 24 each year, with a minimum of one twelfth of basic salary for the year. (pna.gov.ph)

What are the typical government filing reminders a payroll system philippines should automate

Reminders for BIR Form 1601C by the tenth of the following month or eFPS group schedule, SSS PRN generation before SSS cutoffs, and PhilHealth EPRS report creation and payment. (efps.bir.gov.ph)

What penalties can hit if remittances are late

SSS can charge two percent interest per month and serious cases may involve fines or jail for responsible officers. PhilHealth interest can reach up to three percent per month and a single day late counts as a whole month. Pag IBIG can penalize and prosecute non remittance under the HDMF law. (lawyer-philippines.com)

How does data privacy affect payroll operations in the Philippines

If payroll data is breached, the National Privacy Commission requires notifying the Commission and affected individuals within seventy two hours based on available information, with sanctions for failure to notify. A payroll system philippines should include security and breach playbooks aligned to NPC rules. (privacy.gov.ph)

Can one system handle the Philippines and the United States

Yes. Some platforms unify US payroll, Philippines payroll, contractor payments, and EOR for other countries. If you want one vendor for recruiting, payroll, and EOR, explore Bolto pricing.