Best Payroll Software Canada 2026: Top 15 Expert Picks

Canadian payroll has moving parts across federal and provincial rules. Employers need accurate CRA remittances for income tax, Canada Pension Plan, and Employment Insurance, plus province specific items like Quebec Pension Plan and Quebec Parental Insurance Plan through Revenu Quebec. The right stack also supports timely pay runs, benefits, and year end slips like T4 and RL forms without drama. If you are a US based company hiring in Canada or a startup that wants one global view, choosing the best payroll software canada saves time, cuts errors, and keeps teams paid on time. While there are many options, top choices often include QuickBooks Payroll for its deep accounting integration and Rippling for its all-in-one HR, IT, and global payroll capabilities. If you’re not ready to open a Canadian entity, see our Employer of Record in Canada guide.

Facts that matter in Canada

- CRA requires employers to deduct and remit income tax, CPP, and EI from each pay.

- Quebec administers QPP and QPIP through Revenu Quebec in parallel with CRA processes.

- Employers must issue T4 slips and file with CRA by the last day of February for the prior tax year.

- A Record of Employment is required after an interruption of earnings to support EI claims.

- Most provinces mandate minimum vacation pay and statutory holiday pay, so payroll must track entitlements accurately.

If you want a single vendor for recruiting, global payroll, and EOR, Bolto covers payroll and EOR in 150 plus countries, with contractor payments in one flow. See how a unified approach compares to point tools on Bolto.

How We Chose the best payroll software canada list

Selection focused on outcomes that Canadian teams and cross border companies care about.

- Compliance depth in Canada, coverage for T4 T4A RL slips, ROE, CRA and Revenu Quebec, CPP QPP EI QPIP handling

- Support for multi province rules, vacation pay, stat holidays, overtime, termination pay, and province specific health taxes such as the Ontario Employer Health Tax

- Year end automation, PIER checks, pension and EI maximum tracking, and electronic filing

- Contractor and employee support in one place for hybrid teams

- Benefits and RRSP administration or integration

- Time to value, clean onboarding, and helpful support with clear SLAs

- Transparent pricing and total cost of ownership

- Integrations for HRIS, accounting, ATS, and time tracking

- Security posture and data residency options

For US based companies that hire in Canada, the best payroll software canada also needs global EOR or contractor options so you can start without forming a Canadian entity. That is where an all-in-one platform like Bolto Payroll can reduce vendor sprawl.

Key Features You Should Look Out For in Canadian Payroll Software

- CRA and Revenu Quebec remittance automation with correct period codes and remitter frequency

- Automatic CPP or QPP and EI or QPIP calculations with yearly maximums tracked

- ROE e filing support and templates for common separation reasons

- Provincial compliance, Ontario EHT, British Columbia and Manitoba health taxes where applicable, workers compensation reporting links

- T4 T4A RL1 RL2 generation, electronic filing, and employee self serve download

- Multi currency contractor payouts when your team spans Canada and beyond

- Benefits and RRSP integration so deductions map correctly and taxable benefits flow to T4 boxes

- Audit and reporting, general ledger exports, and clean sync to your accounting system

- Strong support, chat or phone response times measured in minutes, not days

If recruiting and payroll live together you can hire faster, then pay correctly from day one. Bolto pairs an AI recruiting marketplace with payroll and EOR, average time to first candidate shortlist is under 72 hours, so new hires can land in your payroll quickly. Learn more on Bolto.

Best Payroll Software Canada: Top 15 (2026)

Building on the criteria above, this section spotlights the 15 payroll platforms most relevant to companies paying staff in Canada in 2026. We grouped these solutions because they reliably handle CRA remittances, T4/RL-1 slips, ROE filings, and multi-province payroll rules while offering modern automation and integrations. Expect a balanced mix of SMB-friendly tools, HRIS suites, and global payroll/EOR options so you can match capabilities to your team’s size and complexity.

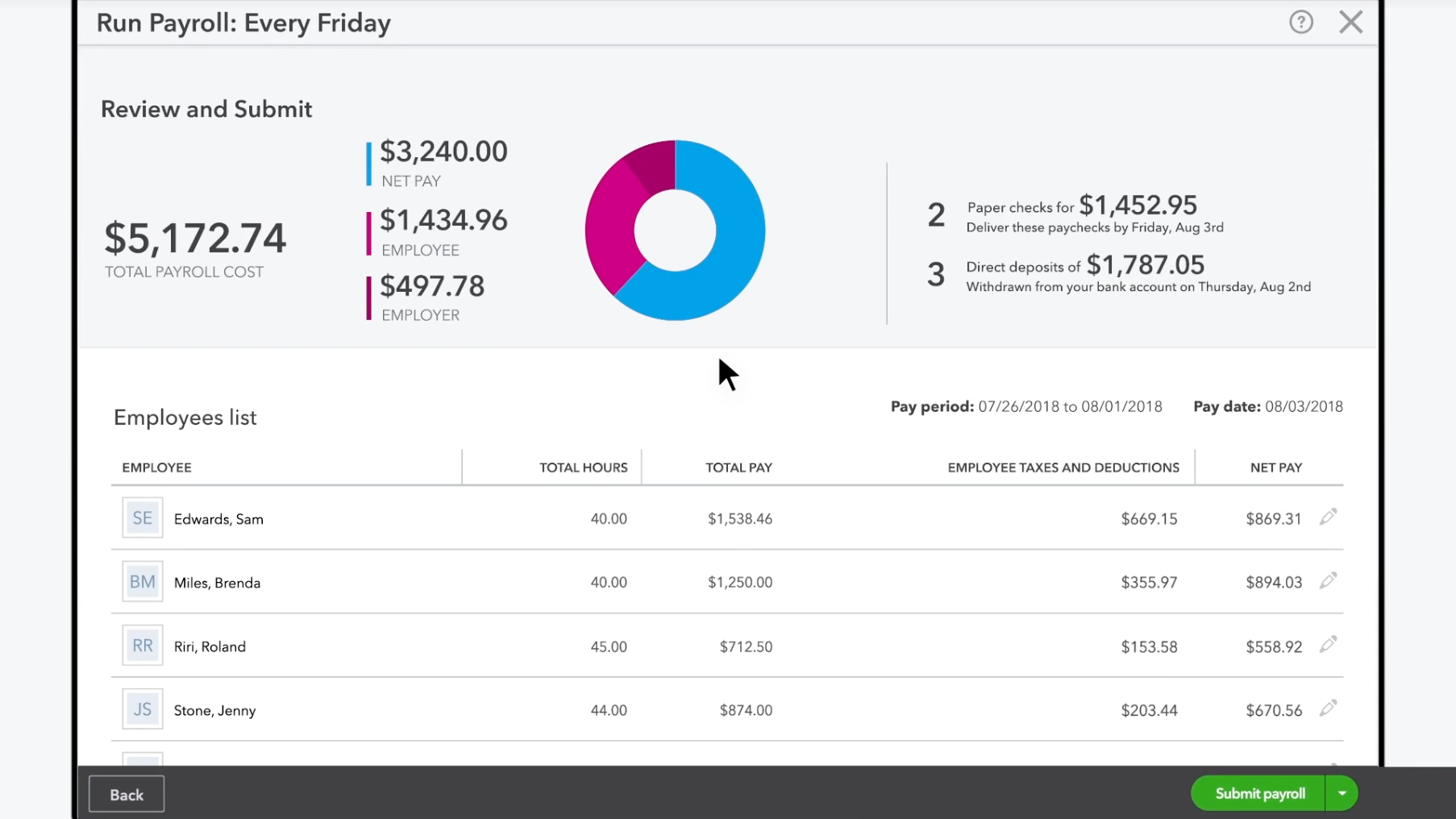

1. QuickBooks Payroll (Canada) - Best for QuickBooks-centric Canadian SMBs

QuickBooks Payroll (Canada) slots directly into QuickBooks Online so finance teams can go from timesheets to payroll to books without hopping tools. Canadian SMBs and US startups with a Canadian entity lean on it for CRA and Revenu Québec compliance, fast direct deposit, and smooth year-end workflows. The draw is how seamlessly it pushes remittances, ROEs, and T-slips through the same interface that already runs your GL.

Why it stands out: Tight QBO/QuickBooks Time integration and next-day deposits in higher tiers make compliant payroll feel as simple as posting a journal.

Canada playbook:

- Automates CRA/RQ deductions and remittances, produces PD7A, supports e-payments.

- Prepares T4, T4A, T5018, RL-1 with CRA/RQ XML; distributes slips via Workforce.

- Calculates CPP/QPP, EI, QPIP, QHSF; tracks WSIB/WSBC/CNESST.

- Handles multi-province rates, vacation/stat holidays, WCB tracking.

- CAD direct deposit: two-day in Core; next-day in Premium/Elite; no contractor deposits.

- Creates ROE files for ROE Web; native QBO and QuickBooks Time sync.

Pricing & who it’s for: Core $25 + $4/employee; Premium $55 + $8; Elite $80 + $15 (CAD/month). Premium/Elite add next-day deposit and QuickBooks Time. Ideal for 1-200+ employees already on QBO, including multi-province and Québec. Requires a Canadian entity; not an EOR.

2. Wagepoint - Best for small Canadian teams on a budget

Wagepoint is Canadian to its core: a straightforward payroll app that makes CRA/RQ remittances, ROEs, and year-end slips feel effortless for small businesses. US startups running a Canadian entity like the transparent pricing and friendly setup, while bookkeepers love how it plugs neatly into QuickBooks Online and Xero.

Why it stands out: Filings and forms are included, support is responsive, and the interface keeps payroll approachable as you grow.

Canada playbook:

- Automated CRA/RQ remittances with on-time e-filing. No PD7A math needed.

- Year-end T4/T4A and RL-1 e-filing; ROE creation/tracking.

- Built-in CPP/QPP, EI, QPIP; Québec workflows supported.

- Multi-province taxes, overtime, and statutory holidays handled accurately.

- CAD direct deposit; cross-border-friendly for US HQs.

- Contractors supported; Time and People modules add onboarding/basic HR.

- Integrates with QuickBooks, Xero, Deputy, uAttend.

Pricing & who it’s for: Solo $20 CAD/month + $4 per active; Unlimited $40 + $6; 14-day trial. Best for 1-100 employees, multi-province teams, or US startups paying Canadians via a local entity. Not an EOR.

3. Payworks - Best for Canada-first payroll with hands-on support

Payworks is a homegrown Canadian payroll and workforce platform serving 40,000+ businesses with domestic hosting and bilingual service. It nails CRA/RQ remittances, PD7A, ROEs, and year-end filing. It’s the preferred Canadian provider for Paychex cross-border customers, which tells you a lot about reliability for US startups expanding north.

Why it stands out: Dedicated, NPI-trained support and polished Canada-specific workflows make compliance routine, not stressful.

Canada playbook:

- CRA/RQ remittances with PD7A scheduling and on-time e-filing.

- T4/T4A and RL-1 e-filing; streamlined ROE creation.

- CPP/QPP, EI, QPIP, plus CPP2/QPP2; Quebec HSF and CNESST.

- Multi-province rules, WCB/WSIB, stat-holiday calculator, flexible schedules.

- CAD EFT direct deposit; cost-centre splits.

- T4A for contractors; requires a Canadian registration (not EOR).

- One-click QuickBooks Online/Xero; optional time and HR modules.

Pricing & who it’s for: Quote-based with base and per-payment fees; extras for ROEs and year-end slips. Great for Canadian SMBs to mid-market or US startups registered in Canada, especially multi-province or Québec teams.

4. Rise People - Best for all-in-one HR, payroll, and benefits in Canada

Rise People unifies HR, payroll, time, and benefits under one Canadian roof, keeping data hosted domestically and compliance front and center. Finance and HR teams appreciate the way CRA remittances, ROEs, and T-slips sit alongside onboarding and time off, so headcount changes flow cleanly into payroll.

Why it stands out: True Canada-specific coverage (including Québec) without giving up ease-of-use or accounting integrations.

Canada playbook:

- CRA remittances and EHT automated with PD7A reconciliation.

- T4/T4A and RL-1 year-end slips; ROE creation and e-filing.

- Accurate CPP/QPP, EI, QHSF/CNESST/RAMQ configurations.

- Multi-province rules for stat holidays, schedules, bank closures.

- CAD direct deposit with split pay and clear cross-border guidance.

- Contractor pay with T4A; HRIS/onboarding; QuickBooks/Xero/FreshBooks.

- Journal entries to major SMB accounting tools.

Pricing & who it’s for: Starts around C$8 PEPM plus a base; add managed payroll, time, benefits (benefits can offset platform fees). Ideal for Canadian SMBs, multi-province teams, and US startups with a CRA RP.

5. Humi - Best for HR-led teams that want payroll inside the HRIS

Humi, now Humi by Employment Hero, is a Canadian HRIS with a modern payroll engine that keeps HR, time off, recruiting, and pay in one place. It’s built for Canadian compliance, supporting CRA/RQ remittances, direct deposit with secure bank verification, and automated slips, which is ideal for SMBs and US startups consolidating their stack.

Why it stands out: Polished HR workflows reduce admin while payroll stays fully Canadian, which is especially handy for Québec teams.

Canada playbook:

- CRA remittances/PD7A tracking; option to self-remit.

- Auto T4s and RL-1s, T4 Summary, ROEs; no T4A issuance.

- CPP/QPP, EI, QPIP; QHSF and CNESST remittances.

- Multi-province maxes, pay schedules, and stat holidays.

- CAD direct deposit with verified accounts (3-4-day funding).

- HRIS onboarding, docs, time off; no contractors/EOR.

- Integrations: Xero payroll journals, QuickBooks imports, Zapier.

Pricing & who it’s for: Quote-based CAD tiers and bundles; optional fully managed payroll. Expect base and service charges for rushes/adjustments. Great for Canadian SMBs and Québec/multi-province teams; US startups need a Canadian entity.

6. Knit People - Best for accountant-run payroll with EOR flexibility

Knit People is a Toronto-built payroll and HR platform popular with SMBs and partner firms. Accounting teams comparing options can use our guide to the best payroll software for accountants.

Why it stands out: Deep Québec support and practical safeguards like PIER-avoidance tools, unlimited off-cycles, and flexible funding (including international wires).

Canada playbook:

- CRA remittances with PD7A schedules and in-app due dates.

- Automated T4/RL-1 generation, XML export, employee portal delivery.

- ROE Web authorized; employees access ROEs in their portal.

- CPP/QPP, EI, QPIP with PIER-avoidance checks.

- Québec CNESST and multi-province rules; stat holidays/overtime.

- CAD direct deposit, Interac e-Transfer, and international wires.

- Contractor pay, optional Canadian EOR, QuickBooks/Xero integrations.

Pricing & who it’s for: Starts at $40 base + $6 PEPM (partner: $29 + $3). Unlimited off-cycles are included, but expedite/NSF/wire fees may apply. Ideal for SMBs, accountant-managed payroll, Québec/multi-province teams, and US startups needing payroll or EOR.

7. ADP - Best for scaling US+Canada payroll in one system

ADP Workforce Now brings a full Canadian payroll engine and bilingual workflows into ADP’s mid-market HCM suite. Companies run US and Canadian employees side-by-side with country-specific pay schedules, keeping cross-border complexity in a single database.

Why it stands out: Robust Canada compliance and automations (including ROE) paired with a marketplace of integrations for time, HR, and finance.

Canada playbook:

- CRA/RQ remittances with PD7A reconciliation and scheduled payments.

- T4/T4A and RL-1/RL-2 e-filing; automated ROEs.

- CPP/QPP, EI, QPIP auto-updates with jurisdictional guidance.

- Multi-province pay frequencies, overtime, statutory holidays.

- CAD direct deposit and cheques; cross-border considerations supported.

- Contractors supported; not an EOR; onboarding/docs built in.

- Integrations via ADP Marketplace; see ADP Canada.

Pricing & who it’s for: Quote-based base + PEPM (monthly or per-pay-period). Some bundles bill year-end/integrations separately. Best for 50–1,000+ headcount, Québec/multi-province needs, and US+CA payroll consolidation.

8. Dayforce - Best for complex, multi-jurisdiction enterprises

Dayforce unifies HR, time, payroll, and analytics with deep Canadian and US payroll baked in. It’s engineered for high-stakes compliance across provinces, with the scale to extend into managed global payroll for 200+ countries, all from one experience adopted by organizations including the Government of Canada.

Why it stands out: Powerful validation and on-demand pay (Dayforce Wallet) in Canada, plus enterprise-grade controls for auditors.

Canada playbook:

- CRA and Revenu Québec remittances with PD7A schedules.

- T4/T4A, RL-1/RL-2, NR4; ROE e-filing to Service Canada.

- CPP/QPP, EI, QPIP with self-PIER tools and year-end validation.

- Multi-province rules, overtime, stat holidays, complex schedules.

- CAD EFT direct deposit; Dayforce Wallet for earned-wage access.

- Contractor workflows; partner EOR options; full HCM modules.

- Integration Studio/Exchange for finance, time, HRIS, ATS.

Pricing & who it’s for: Quote-based and modular; costs scale with scope/headcount. Add Managed Payroll; Wallet included with Payroll. Best for mid-market/enterprise, multi-province teams, and consolidating US+CA payroll.

9. Push Operations - Best for Canadian restaurants and hospitality

Push Operations ties scheduling, time, tips, and POS sales directly into payroll, which is exactly what hospitality teams need to stay compliant and on time. If you’re evaluating options, see our guide to payroll software for hospitality.

Why it stands out: Purpose-built for restaurants. Think tip pools, POS integrations, and shift-aware payroll that handles the messy parts for you.

Canada playbook:

- CRA deductions and PD7A remittances automated on schedule.

- T4/T4A generation and ROE support with ROE Web exports.

- CPP/EI and QPP/QPIP; Québec CNESST/RAMQ supported.

- Multi-province taxes, overtime, stat-holiday calculations.

- CAD direct deposit with splits; cross-border-friendly setup.

- Contractor support; onboarding, docs, basic HRIS included.

- Integrates with restaurant POS, time tools, QuickBooks/Xero.

Pricing & who it’s for: Starts at $5 per user (five-employee minimums); no base fees, unlimited runs. Signature adds multi-province and migration; >50 employees usually quote-based. Ideal for restaurant groups and US startups with Canadian entities.

10. Rippling - Best for unified HR/IT with US+CA payroll (and EOR)

Rippling brings HR, payroll, IT, and spend into one platform and now runs native payroll across all Canadian provinces, including Québec. US startups love that they can pay US and Canadian teams in one flow, automate filings, and add EOR for Canada if they’re not ready to open an entity.

Why it stands out: Lightning-fast runs, automated CRA/RQ filings, and 650+ integrations spanning HR and finance.

Canada playbook:

- CRA and Revenu Québec remittances handled; PD7A included.

- T4/T4A and RL-1 generation/filing; ROE creation/tracking.

- CPP/QPP, EI, QPIP, EHT; supports CNESST/RAMQ.

- Multi-province rates, stat holidays, regional leave.

- CAD direct deposit or cheque; cross-border FX supported.

- Contractors and Canada EOR; onboarding, HRIS, docs.

- Integrates with QuickBooks, Xero, NetSuite, Intacct, and more.

Pricing & who it’s for: Modular, quote-based PEPM plus base; Payroll, Global Payroll, EOR, and Time are add-ons. Best for US startups and SMBs needing unified US+CA payroll with EOR flexibility.

11. Papaya Global - Best for global payroll with strong Canada/EOR coverage

Papaya Global centralizes payroll, EOR, contractors, and workforce payments so you can hire compliantly in Canada and pay via local rails. US startups lean on it to start fast with EOR, then transition to their own Canadian entity without swapping systems.

Why it stands out: Built-in payments (same-day via tier-1 rails) plus province-aware compliance guidance keep cross-border operations moving.

Canada playbook:

- CRA remittances, PD7A schedules, and RQ filings automated.

- T4/T4A and RL-1 generation; ROE submissions handled.

- CPP/QPP, EI, QPIP; HSF, WSIB/WorkSafeBC, CNESST, RAMQ.

- Multi-province taxes, stat holidays, flexible pay schedules.

- Funds in CAD; direct deposit, FX, worker wallets.

- EOR and AOR for contractors; onboarding, basic HRIS, docs.

- Integrations: BambooHR, HiBob, NetSuite, SAP Fieldglass, APIs.

Pricing & who it’s for: Workforce OS from $5 PEPM; Payroll Plus from $25; EOR from $599; Contractors from $30; AOR from $200; payments from $2.50/txn (Jan 2026). Great for US startups and multi-province teams consolidating US+CA payroll and payouts.

12. Wave Payroll - Best for very small teams outside Québec

Wave Payroll is a lightweight add-on that pairs with Wave Accounting to run compliant payroll across Canada, except for Québec. It’s a budget-friendly way for tiny teams and US startups with a Canadian entity to automate remittances and year-end slips without adopting a full HCM.

Why it stands out: Simple workflows, clear pricing, and just enough automation for small shops.

Canada playbook:

- Automatic CRA remittances via direct debit; PD7A handled.

- T4/T4A generation; ROE e-filing supported.

- CPP/EI calculations; Québec programs (QPP/QPIP/CNESST/RAMQ) not supported.

- Multi-province taxes and statutory holidays outside Québec.

- Unlimited CAD direct deposits; ~3-day funding.

- Employees and contractors supported; no EOR.

- Syncs to Wave Accounting; Zapier/Make for time.

Pricing & who it’s for: CA$25 base + CA$6/employee + CA$6/contractor (Jan 2026). Ideal for 1–20 people outside Québec and US startups with a Canadian entity who want simple, low-lift payroll.

13. Deel - Best for starting on EOR, then migrating to in-house payroll

Deel is a global HR, payroll, and EOR platform that lets you employ in Canada via its EOR or run native payroll for your own entity. That flexibility makes it a favorite for US startups hiring their first Canadians and later transitioning to in-house payroll without rebuilding processes.

Why it stands out: A single workflow for contractors, EOR employees, and entity-based payroll, plus mature finance integrations.

Canada playbook:

- CRA remittances automated and reconciled against PD7A.

- T4/T4A and ROE data generated with secure records.

- CPP/QPP, EI/QPIP, RL-1, CNESST, RAMQ supported.

- Multi-province taxes, stat holidays, compliant scheduling.

- CAD direct deposit with funding and FX support.

- Contractors, EOR, onboarding, and core HRIS in one.

- Integrations: QuickBooks, Xero, NetSuite, Sage Intacct.

Pricing & who it’s for: Canada Global Payroll from $29 PEPM (plus ~$1,000 implementation), EOR from $599, Contractors from $49; US payroll from $19. Best for US startups and multi-province teams needing a bridge from EOR to owned payroll.

14. Multiplier - Best for flat-price Canadian EOR at speed

Multiplier is a global EOR and payroll platform covering every Canadian province and territory. It lets US startups hire their first Canadian employees quickly. Multiplier becomes the legal employer, handles local tax registrations, and runs compliant CAD payroll with localized benefits.

Why it stands out: Transparent, flat EOR pricing and optional immigration support keep expansion costs predictable.

Canada playbook:

- Automates CRA remittances and PD7A submissions.

- Generates T4/T4A, issues ROE, maintains compliant records.

- CPP/QPP, EI, QPIP calculated with correct thresholds.

- Québec specifics: RAMQ, CNESST, provincial taxes.

- Multi-province rules, overtime, stat holidays.

- CAD direct deposit, currency controls, consolidated reports.

- Contractors and EOR; onboarding, HRIS, key integrations.

Pricing & who it’s for: EOR from $400 per employee/month; contractors $40/contractor/month; Global Payroll is quote-based. Add-ons for benefits and immigration. Great for pre-seed to Series B US startups needing fast, compliant hiring in Canada.

15. QuickBooks - Best for accounting-led payroll stacks

QuickBooks is the SMB accounting staple, and its Canadian payroll add-on (or partner integrations) keeps books, payroll, and year-end slips in one tidy flow. Canadian businesses and US startups with a Canadian entity benefit from CRA/RQ e-filing, ROE creation, and Québec support without bolting on complex HCM.

Why it stands out: If your finance ops already live in QuickBooks, payroll sync and tax workflows are practically on autopilot.

Canada playbook:

- CRA remittances with PD7A in the Payroll Tax Centre and e-filing.

- T4/T4A XML, employee copies, and ROE .BLK exports.

- CPP/QPP, EI, QPIP with annual max guardrails.

- Multi-province tax changes, pay schedules, statutory holiday rules.

- CAD direct deposit (no contractor direct deposit currently).

- Plays nicely with Deel/Remote for EOR/contractor sync.

- One-click: Wagepoint, QuickBooks Time, and popular HRIS/ATS.

Pricing & who it’s for: Typical CAD payroll tiers: Core $25 + $4/employee; Premium $55 + $8; Elite $80 + $15 (accounting sold separately; bundles exist). Ideal for SMBs already on QuickBooks, multi-province teams, or US startups paying Canadians via a local entity.

Buying Guide: Pro Tips and Pitfalls for Canadian Payroll Vendors

Pro tips

- Ask how the system handles Quebec, QPP and QPIP require separate logic from CPP and EI

- Confirm T4 plus RL workflows if you employ in Quebec, many tools get one set right and struggle with the other

- Verify ROE timelines and e filing status so you can issue within the required window after an interruption of earnings

- Check province specific rules for stat holidays and vacation pay, look for configuration by province and by employee class

- Map benefits and taxable benefits to the correct T4 boxes before the first pay run

Pitfalls to avoid

- Picking a US only payroll that lacks Canadian remittance and year end support

- Running separate systems for employees and contractors, which creates reconciliation risk

- Underestimating year end prep, PIER reports catch CPP and EI under or over contributions and can trigger costly corrections

- Ignoring data residency and access controls, especially if you serve regulated industries

For teams that hire in Canada and other countries, the best payroll software canada is often a global payroll solution with EOR and contractor management. See how a single vendor model works on Bolto.

Demo Questions to Ask Canadian Payroll Software Providers

Use these questions to separate marketing from reality.

- How do you handle CPP versus QPP and EI versus QPIP in the same company file

- Can you produce T4 T4A RL1 RL2 and file them electronically within the tool

- What is your ROE process and can you file ROE directly

- How do you support Ontario EHT thresholds and other provincial taxes

- Do you offer automated CRA and Revenu Quebec remittances with confirmation numbers

- What are your year end checks for PIER issues and how are corrections handled

- Can I pay employees and contractors in one pay cycle and one invoice

- What are your average first response and resolution times for payroll tickets

- Do you integrate with my HRIS ATS and accounting tools

- For US based companies, can you support EOR in Canada before we register an entity

If a vendor cannot show these live, keep looking. The best payroll software canada should answer yes to most of the above.

Benefits and ROI of Using Canada Specific Payroll Software

- Lower penalties and interest, accurate CPP or QPP and EI or QPIP remittances reduce CRA notices

- Faster year end, automated T4 and RL filing cuts hours of manual work and avoids slip reissues

- Better employee experience, self serve pay stubs and tax slips build trust

- Cleaner books, automated GL posts and reconciliations save finance time

- Scalable processes, new provinces and new benefits become configuration, not a project

Real world outcomes from Bolto customers show how speed and integration pay off.

- Fiber AI made five engineering hires and built the entire team in 10 days, with 100 percent retention after onboarding

- Sports gaming platform Rebet filled four engineering roles in under five weeks with a 5.6 day average time to hire and 100 percent retention

- Assembly made the first hire in 15 days from the first call and finished onboarding in under two days

When recruiting and payroll live together, time to productivity improves. Explore the unified route on Bolto.

Implementation: How to Get Started With Canadian Payroll Software

- Decide your hiring model in Canada, entity based employment, EOR, or contractors

- Collect employer account numbers, CRA payroll number, Revenu Quebec numbers if you hire in Quebec, workers compensation accounts

- Configure provinces, earnings, benefits, and time off rules

- Add direct deposit details and test your first off cycle run with one or two employees

- Connect HRIS, time tracking, and accounting

- Train admins and publish an employee self serve guide

- Schedule your first year end prep session well before January to review PIER checks

If you prefer an all in one setup for recruiting, payroll, EOR, and contractor payments, Bolto offers US payroll and global coverage including Canada. Pricing is transparent, US payroll starts at 39 to 49 per employee per month plus a platform fee, Global EOR is 599 per employee per month, Contractor of Record is 299 per contractor per month, and Contractor Management is 49 per month. Talk to a specialist at Bolto.

Conclusion

Running payroll in Canada requires precision across CRA and Revenu Quebec, plus province specific rules. The best payroll software canada should automate remittances, support ROE and year end slips, and integrate with your hiring and HR workflow. If your company is US based and building a cross border team, a single vendor for recruiting, payroll, and EOR can shrink time to hire and reduce errors. To see how a unified stack can support hiring and paying Canadian talent, visit Bolto.

FAQs

What makes the best payroll software canada different from US only tools

Canada requires CPP or QPP and EI or QPIP calculations, CRA and Revenu Quebec remittances, ROE filing, and T4 and RL slip generation. US only tools usually lack these features.

Can I start hiring in Canada without opening a local entity

Yes, through an Employer of Record. The best payroll software canada for cross border teams includes EOR so you can hire quickly while staying compliant. You can explore a unified approach with Bolto.

When are T4 slips due

Employers must issue and file T4 slips by the last day of February for the previous calendar year. The best payroll software canada automates this process and provides employee self serve access.

Do I need to issue an ROE for every termination

Issue an ROE when there is an interruption of earnings, including terminations, certain leaves, and long unpaid absences. The best payroll software canada should let you create and e file ROEs directly.

How do Quebec rules affect my payroll setup

Quebec uses QPP and QPIP managed through Revenu Quebec, plus RL slips at year end. Choose the best payroll software canada that supports dual filing with CRA and Revenu Quebec.

Can I pay employees and contractors together

Yes. The best payroll software canada should support employees and contractors in one flow with single invoice reconciliation. Platforms like Bolto also handle multi currency contractor payments.

What support response time should I expect

Aim for live support with first responses measured in minutes. For example, Bolto markets dedicated human support for EOR clients and priority support on higher payroll tiers.

How quickly can I go live

With prepared data and a focused team, many companies complete configuration and a test run within one to two weeks. If you also recruit, platforms that integrate hiring can place candidates into payroll even faster, average time to first candidate shortlist with Bolto is under 72 hours.